The other day I was in my financial planner’s office talking college vs. retirement. You think doing your taxes hurt? Have this convo. We literally dug into my finances, what I am projected to make, what I am worth (literally people, there is a dollar sign over your head) and how much I can afford to put away for (1) myself so I’m not eating cat food next to the rest of the bums in Union Square in a few years and (2) so I can try and make sure my son will have a cushion of cash when he goes to college.

Wait did I say cushion? Not paid for? Yes – I did. After some serious financial research, we found out that the average yearly tuition for Maximo will be about $150,000 PER YEAR once he gets to college. Let me sum that up for you – my ENTIRE college tuition at Clarion University AND GRAD SCHOOL at Point Park University combined didn’t cost that much, or even come close.

I swallowed and thought about it for a moment. Here I am already paying for Pre-K – he can find a way to pay for his own damn college, right?

Here’s the thing. Even if he DOES get a full scholarship to college (ahem, which he will of course) it doesn’t cover everything. What if he wants to travel abroad? What if he ends up going to grad school like his super cool mother before him? And don’t expect financial aid to help. I may be a single mom but the government doesn’t think that qualifies my son to a free education.

So – what can we do? We crunched numbers – literally. Franck ran them through a system to find out exactly how much I can afford and should be putting away each month. Even in NYC as a single parent, I can afford to do it. You can, too – even if it’s only $25 a month.

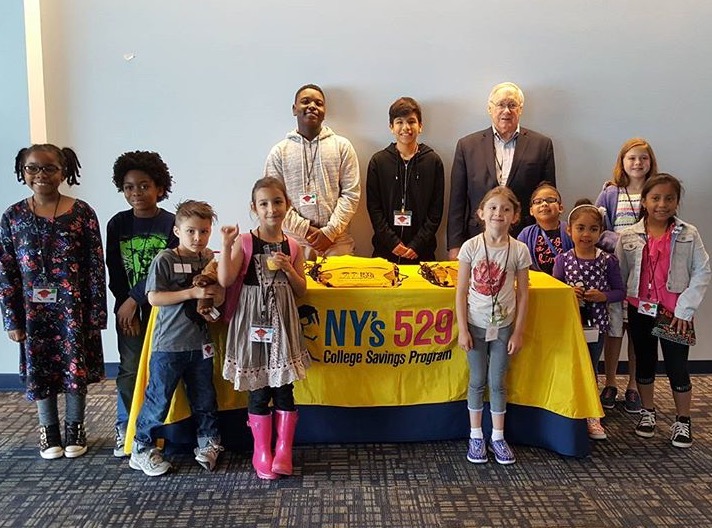

Meet Geanine. Geanine does not have a 529 Plan. Geanine thinks I am laughing at my own jokes, but I just set her up with a 529 fund and she doesn’t know it yet – it was that easy!

So, what and where do you save?

When I was pregnant, I set up a NY 529 Direct College Savings Plan for Maximo. We put all the money from the baby shower, his Baptism, birthdays and Christmas into this fund (seriously, how many toys can one kid really need?). He also does modeling (yes, you’ve seen him on Walmart.com and Toys R Us), and thankfully now there is a law that child labor REQUIRES a Trust fund and 15% of all earned money MUST go into this fund – so the parents can’t spend it. I think it should be 100% personally.

But a NY 529 Direct College Savings Plan can only be used for college, right?

There has always been a gray area around what you can spend that money on without a penalty. If you’re stuffing away money every month instead of ordering more Seamless or walking instead of taking cabs, you want to make sure you’re getting the most out of it, right?

I sat down the other day with Pete Grannis, First Deputy to the Controller, and Michael Turner from the NYS Higher Education Services Corporation, and I grilled them on all the questions you might have. Seriously – read this:

Me: What does a NY 529 Direct College Savings Plan cover, exactly…higher education? Vocational Schools?

NYState: NY 529 Direct College Savings Plans are meant for higher education, so no, you can’t use it for Pre-K or private schools until after 12th grade. It will however cover any accredited school by the Department of Education. You’ll have to check their website for a full list, but basically this covers culinary school, art institutes and even automotive school – not just NYU and Harvard (you do NOT have to attend college IN NY state). It can also be used for grad school – so if they continue on, or get a full ride to undergrad, those funds can be used for that as well.

Me: What if he doesn’t go to school. That’s the question, right? What can we do with that money?

NYState: You can transfer the money into any beneficiary’s name – as long as they use it for higher education. You can give it to a family member, yourself (Hey! I always have wanted to get my Doctorate at Columbia!), or if anything, you can take it out – with a penalty (and let’s get away from the word “penalty” – since this money is allowed to be tax-free – but to be completely technical – there is a 10% tax on earnings in the account if you choose to cash it out on anything other than higher learning. Learn more here.). But it’s not like that money will be wasted. And with the rising costs of college, by the time our kids make it to college, it’s more than likely you’ll find a way to use it.

Me: Why should we choose a NY 529 Direct College Savings Plan over other means of savings accounts?

NYState: Contrary to popular belief, NY 529 Direct College Savings Plans DO NOT count against you when applying for college funding. Since the NY 529 Direct College Savings Plan is under the parent’s name, not the beneficiary, it doesn’t affect them. Literally, everyone at the NY Financial Aid Department has them – would they if they knew they would be penalized for them? Also, certain age-based portfolios are more conservative than other options as they get older (meaning they are less risky as they age).

Me: What’s the difference between a trust and a NY 529 Direct College Savings Plan?

NYState: Trusts take up to 20% while a NY 529 Direct College Savings Plan only takes 5%.

Me: So a NY 529 Direct College Savings Plan is tax-free?

NYState: Yes. While you have to claim money in other portfolios, you will not receive a 1099 at tax season for NY 529 Direct College Savings Plans. Plus, NY State residents get a tax-deduction of up to $5,000 per year ($10,000 if filing jointly).

So how do you get started?

It’s easy – literally you can open a NY 529 Direct College Savings Plan with as little as $25. Go to www.NYSaves.Org and set one up today online with a few steps. There are no income restrictions for setting one up either, and no minimum monthly or yearly contribution limits.

Still scared or confused? You can always reach out to me for any questions – or heck, even call/email my Financial Planner. Tell him Stephanie sent you and he’ll be more than willing to answer any questions or help you do a full report of your finances to see how much you can afford to put away, too. Now – what about retirement, right? That’s an entire other story. Till next time!

Franck Cushner, Principal, Ensemble Financial

FCushner@ensemblefinanical.com

212-489-1800

Way to scare me! I thought I had time to plan this out after the baby arrived, but now realize I should start thinking about this now. Thanks for providing this information as a starting point for me.

What an impressive post! I wonder how many parents know about the NY 529? It’s such a beneficial program.